Uniquely Indian, undeniably global asset management.

IIFL Asset Management is an India-focussed, global asset management firm.

360 ONE ELSS Tax Saver Nifty 50 Index Fund

|

Product Downloads

Application Form

Scheme Information Document

Key Information Memorandum

Click here to Invest Now

Type of Scheme:

An open ended Passive Equity Linked Saving Scheme with a statutory lock-in period of 3 years and tax benefit, replicating/tracking the Nifty 50 index.

Investment Objective:

The investment objective of scheme is to invest in stocks comprising the Nifty 50 Index in the same proportion as in the index to achieve returns equivalent to the Total Returns Index of Nifty 50 Index (subject to tracking error), while offering deduction on such investment made in the scheme under section 80C of the Income-tax Act, 1961. It also seeks to distribute income periodically depending on distributable surplus.

There is no assurance or guarantee that the investment objective of the Scheme would be achieved.

Investments in this scheme would be subject to a statutory lock-in of 3 years from the date of allotment to avail Section 80C benefits.

Benchmark:

Nifty 50 TRI

Asset Allocation:

The investment policies of the Scheme shall be as per SEBI (Mutual Funds) Regulations, 1996, and within the following guidelines. Under normal market circumstances, the investment range would be as follows:

| Instruments | Indicative Allocation (% of Net assets) | Risk Profile | |

|---|---|---|---|

| Minimum | Maximum | ||

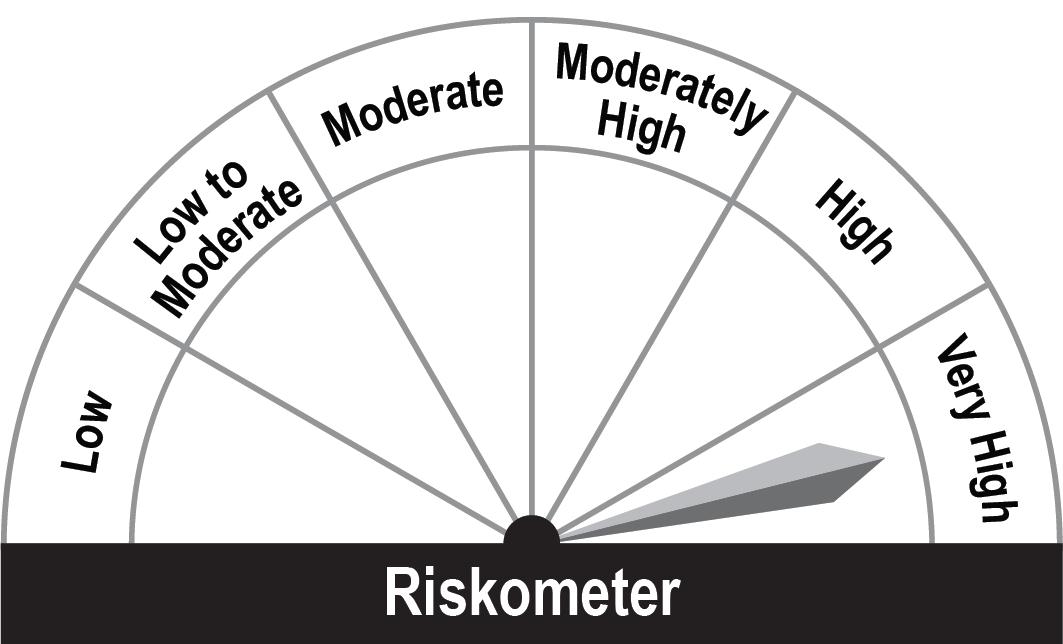

| Equity instruments covered by Nifty 50 Index | 95% | 100% | High |

| Debt and Money market instruments | 0% | 5% | Low to Moderate |

The scheme may also invest upto 5% in liquid schemes of 360 ONE Mutual Fund (formerly known as IIFL Mutual Fund) or other schemes which has objective to invest in debt and money market instruments.

For more information on Asset Allocation, refer the Scheme Information Document.

Minimum Application Amount:

New Purchase - Rs.500/- and in multiples of Rs.500/- thereafter.(subject to lock-in-period of 3 years from the date of allotment)

Additional Purchase - Rs.500/- and in multiples of Rs.500/- thereafter.(subject to lock-in-period of 3 years from the date of allotment)

Systematic Investment Plan (SIP)

- Weekly Option - Rs.500 per instalment (subject to lock-in-period of 3 years from the date of allotment) for a minimum period of 12 weeks. Default day triggered every Tuesday.

- Fortnightly Option - Rs. 500 per instalment (subject to lock-in-period of 3 years from the date of allotment) for a minimum period of 12 fortnights triggered on 2nd & 16th of every month.

- Monthly Option - Rs. 500 per month and in multiples of Rs. 500 thereafter (subject to lock-in-period of 3 years from the date of allotment). Minimum number of instalments to be 12.

- Quarterly Option - Rs.500 per quarter and in multiples of Rs. 500 thereafter (subject to lock-in-period of 3 years from the date of allotment). Minimum number of instalments to be 12.

Note:* Weekly and Fortnightly SIP frequencies are not available on BSE STAR MF platform.

Load Structure:

Entry Load: Not Applicable

The upfront commission, if any, on investment made by the investor shall be paid by the investor directly to the Distributor, based on his assessment of various factors including the service rendered by the Distributor.

Exit Load: NIL

Fund Manager:

Mr. Parijat Garg

Tracking Error (%):

Regular - 0.14

Direct - 0.14

Tracking Difference as on 30th November 2024 (in %):

Regular - 0.61

Direct - 0.35

Monthly disclosure document - November 2023

Nifty 50 Constituents – As on 13 July 2023

* Fund exists for less than one year. So, the tracking error is calculated by annualising available data

Click here to Invest Now

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.