Uniquely Indian, undeniably global asset management.

IIFL Asset Management is an India-focussed, global asset management firm.

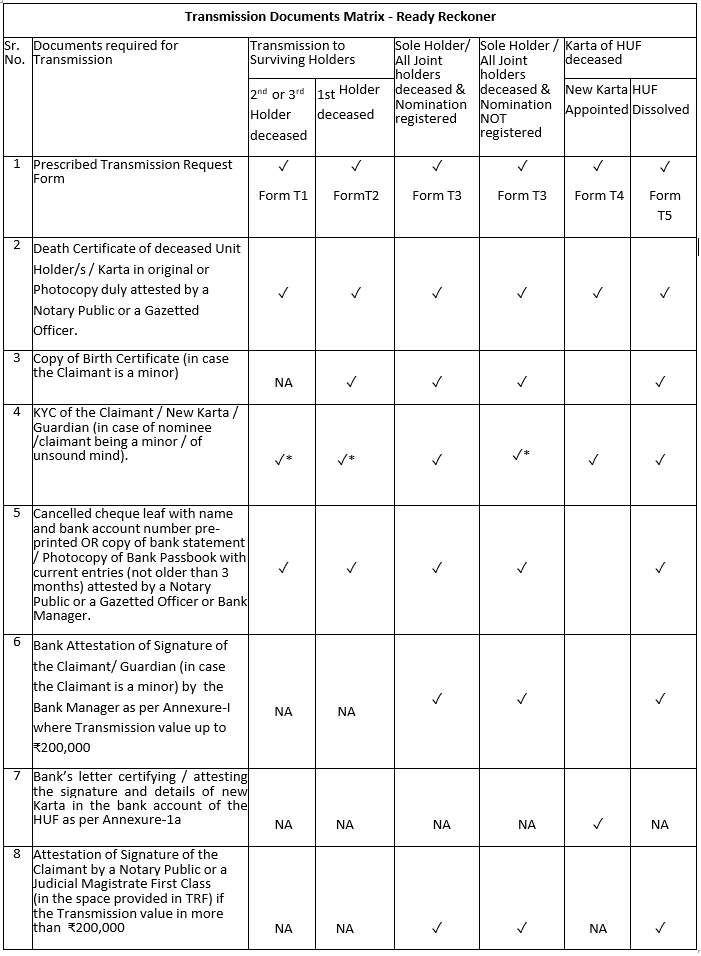

Procedure For Transmission Of Units

Transmission of Units is a process whereby units held by a deceased unit holder are transferred either to the nominee or to the legal heirs of the deceased unit holder as the case may be.

The detailed guidelines for Transmission of Units under various situations / scenarios and the forms/formats and supporting documents to be submitted by the claimants under each scenario is provided below.

Guidelines for Transmission Procedure

The list the documents required for transmission under various situations is explained in the following paragraphs:

i. Request Form (Form T1) from surviving unitholder(s) requesting for Deletion of Name of Deceased 2nd and/or 3rd Holder.

(Link to download Form T1)

ii. Death Certificate in original or photocopy duly attested by a Notary Public or a Gazetted Officer.

iii. Fresh Bank Mandate Form along with cancelled cheque of the new bank account (only if there is a change in existing bank mandate)

iv. Fresh Nomination Form in case there is no nomination or a change in existing nomination is desired by the surviving unit holders.

v. KYC Acknowledgment OR KYC Form of the surviving unit holder(s), if not KYC compliant.

i. Transmission Request Form (Form T2) for Transmission of Units to the surviving unitholder/s.

(Link to download Form T2)

ii. Death Certificate of the deceased unitholder(s) in original OR photocopy duly attested by a Notary Public or a Gazetted Officer.

iii. Copy of PAN Card of the Surviving Joint Holder(s) (if PAN is not provided already)

iv. Cancelled cheque of the new first unitholder, with the claimant’s name pre-printed OR Recent Bank Statement/Passbook (not more than 3 months old) of the new first holder.

v. KYC Acknowledgment OR KYC Form of the surviving unit holder(s), if not KYC compliant.

vi. Copy of Birth Certificate (in case the Claimant is a minor)

i. Transmission Request Form (Form T3) for Transmission of Units in favour of the Nominee(s).

(Link to download Form T3)

ii. Death Certificate of the deceased unitholder(s) in original OR photocopy duly attested by a Notary Public or a Gazetted Officer.

iii. Copy of Birth Certificate, in case the Nominee is a minor.

iv. Copy of PAN Card of the Nominee(s) / Guardian (in case the Nominee is a minor)

v. KYC Acknowledgment OR KYC Form of the Nominee(s) / Guardian (where Nominee is a Minor / unsound mind)

vi. Cancelled cheque with the Nominee’s name pre-printed OR Copy of the Nominee’s recent Bank Statement/Passbook (which is not more than 3 months old).

vii. If the transmission amount is upto ₹2 Lakh, Nominee’s signature attested by the Bank Manager as per Annexure-Ia. In case the Nominee is a Minor, signature of the Guardian (as per the bank account of the Minor or the joint account of the Minor with the Guardian) shall be attested. If the transmission amount is for more than ₹2 Lakh, as an operational risk mitigation measure, signature of the Nominee shall be attested by a Notary Public or a Judicial Magistrate First Class (JMFC) in the space provided for signature attestation in the TRF itself below the signature of the claimant.

(Link to download Annexure-1a)

i. Transmission Request Form (Form T3) for Transmission of Units to the Claimant

(Link to download Form T3)

ii. Death Certificate of the deceased unitholder(s) in original OR photocopy duly attested by a Notary Public or a Gazette Officer.

iii. Copy of Birth Certificate in case the Claimant is a minor.

iv. Copy of PAN Card of the Claimant / Guardian (in case the Claimant is a minor).

v. KYC Acknowledgment OR KYC Form of the Claimant / Guardian (in case the Claimant is a Minor / unsound mind)

vi. Cancelled cheque with the claimant’s name pre-printed OR Copy of the Claimant’s recent Bank Statement/Passbook (which is not more than 3 months old).

If the transmission amount is up to ₹2 Lakh –

a. Bank Attestation of signature of the Claimant by the Bank Manager as per Annexure-Ia. In case the Claimant is a Minor, the signature of the Guardian (as per the bank account of the Minor or the joint account of the Minor with the Guardian) shall be attested.

(Link to download Annexure-1a)

b. Any appropriate document evidencing relationship of the claimant/s with the deceased unitholder/s.

c. Bond of Indemnity - as per Annexure-II → to be furnished by Legal Heirs for Transmission of Units without production of Legal Representation. Provided that in case the legal heir(s)/claimant(s) is submitting the Succession Certificate or Probate of Will or Letter of Administration wherein the claimant is named as a beneficiary, an affidavit as per Annexure-III from such legal heir/claimant(s) alone would be sufficient; i.e., Bond of Indemnity is not required.

(Link to download Annexure-II)

d. Individual Affidavits to be given by each legal heir as per Annexure-III

(Link to download Annexure-III)

e. NOC from other Legal Heirs as per Annexure – IV, where applicable.

(Link to download Annexure-IV)

If the transmission amount is more than ₹2 Lakh –

a. Signature of the Claimant duly attested by a Notary Public or a Judicial Magistrate First Class (JMFC) in the space provided for signature attestation in the TRF itself below the signature of the claimant. In case the Claimant is a Minor, the signature of the Guardian (as per the bank account of the Minor or the joint account of the Minor with the Guardian) shall be attested.

b. Individual Affidavits to be given each legal heir as per Annexure-III

(Link to download Annexure-III)

c. Any one of the documents mentioned below:

✓ Notarised copy of Probated Will; OR

✓ Succession Certificate issued by a competent court; OR

✓ Letter of Administration or court decree, in case of Intestate Succession

If the case of a HUF, the property of the HUF is managed by the Karta and the HUF does not come to an end in the event of death of the Karta. In such a case, the members of the HUF will need to appoint a new Karta, who needs to submit following documents for transmission:

i. Request Form (Form T4) for change of Karta upon demise of the registered Karta.

(Link to download Form T4)

ii. Death Certificate of the deceased Karta in original OR photocopy duly attested by a Notary Public or a Gazette Officer.

iii. Bank’s letter certifying that the signature and details of new Karta have been updated in the bank account of the HUF & attesting the Signature of the new Karta as per Annexure-1b.

(Link to download Annexure-1b)

iv. KYC Acknowledgment OR KYC Form of the new Karta and the HUF, if not KYC compliant.

v. Indemnity Bond as per Annexure V signed by all surviving coparceners (including new Karta).

(Link to download Annexure-V)

vi. If the transmission amount is upto ₹2 Lakh, any appropriate document evidencing relationship of the new Karta and the other coparceners with the deceased Karta.

vii. If the transmission amount is more than ₹2 Lakh, any one of the documents mentioned below –

→ Notarized copy of Settlement Deed, or

→ Notarized copy of Deed of Partition, or

→ Notarized copy of Decree of the relevant competent court.

In case of no surviving co-parceners and the transmission value is more than ₹200,000 OR where there is an objection from any surviving members of the HUF.

i. Transmission Request Form (Form T5) for Transmission of Units to the Claimant.

(Link to download Form T5)

ii. Death Certificate of the deceased Karta in original OR photocopy duly attested by a Notary Public or a Gazette Officer.

iii. Copy of Birth Certificate in case the Claimant is a minor.

iv. Copy of PAN Card of the Claimant(s) / Guardian (in case the Claimant is a minor)

v. KYC Acknowledgment OR KYC Form of the Claimant(s) / Guardian (in case the Claimant is a Minor / unsound mind)

vi. Cancelled cheque with the claimant’s name pre-printed OR Copy of the Claimant’s recent Bank Statement/Passbook (which is not more than 3 months old).

vii. If the transmission amount is upto ₹2 Lakh, attestation of signature of the claimant by Bank Manager as per Annexure-Ia. In case the claimant is a Minor, the signature of the Guardian (as per the Minor’s bank account / Minors joint account with the Guardian) shall be attested.

(Link to download Annexure-1a)

If the transmission amount is for more than ₹2 Lakh, signature of the claimant shall be attested by a Notary Public or a Judicial Magistrate First Class (JMFC) in the space provided for signature attestation in the TRF itself below the signature of the claimant.

viii. Bond of Indemnity to be furnished by the Claimant as per Annexure-VI.

(Link to download Annexure-VI)

ix. If the HUF has been dissolved/partitioned by the surviving members after demise of the Karta, the transmission of units should be effected only on the basis of any of the following documents:

→ Notarized copy of Settlement Deed, OR

→ Notarized copy of Deed of Partition, OR

→ Notarized copy of Decree of the relevant competent Court.

a. In case of death of the 1st holder, if there are two surviving joint holders, the surviving 2nd holder will be treated as the new primary / 1st holder.

b. PAN card copy of the nominee /claimant/s need not be insisted separately, if the same is available in KYC data. In case of residents of Sikkim, appropriate Id. proof shall be collected in lieu of PAN card.

c. Where the units are to be transmitted to a claimant who is a minor, various documents like KYC, PAN, Indemnity should be of the Guardian of the minor nominee / legal heir. Bank Attestation of the Signature of the Guardian of the minor shall be as per the bank account of the Minor or the joint account of the Minor with the Guardian.

d. In case of multiple nominees/ claimants, the monetary threshold of more than ₹2 lakh for the purpose of obtaining the Indemnity Bond shall be the determined on the basis of the aggregate value of the Units under all the folios for which the claim is being submitted as per the latest NAV as on the date of receipt of the claim, before dividing / splitting the claim amongst multiple nominees or claimants/ surviving co-parceners.

e. Also, where there are more than one nominees / legal heirs (claimants) in a folio or set of folios, the nominees / legal heirs should be encouraged / requested to submit the Transmission request together, so that all the Units held by the deceased unitholder(s) could be transmitted in one-go to for operational efficiency and convenience.

f. If the deceased unitholder(s) held units in several folios, as 1st holder(s) in some folios and as joint holder in other(s), a single claim form may be accepted for operational ease, provided the ALL the deceased holders are common across the multiple folios (irrespective of the order of names) AND the nominee(s) / claimant(s) is/are also common/same across ALL the folios.

g. Once a transmission request is received, it is incumbent upon the AMC/RTA to determine if the deceased unitholder had any unit holdings under any other scheme / folio, and put a flag in the system against all other folios of the deceased unitholder, basis PAN / PEKRN with a suitable communication to the surviving unitholders / nominee/s (if any, registered against the folios) to submit the claim form with reqd. documents in respect of the remaining folios.

h. In such cases where the deceased was the 1st holder in respect any one of the folios/funds, units in all other holdings across all other folios/schemes, where the deceased was the 1st unitholder shall be ‘Stop’ marked/blocked against any further transactions basis PAN or PEKRN.

i. The process and documentation for transmission of units where the claimant / nominee is a mentally unsound person, shall be the same as applicable to a Minor claimant, except that the Guardian shall be a court appointed guardian. Additionally, a Medical Certificate from an appropriate registered medical practitioner may be obtained regarding the Mentally unsound person.

j. Copies of all supporting documents submitted for settlement of the claim, such as the Death Certificate of the deceased, Birth certificate of the minor, Probate of Will, Succession Certificate, Letter of Administration shall be duly attested by a Notary Public or a Gazette Officer.

k. If the transmission amount is for more than ₹2 Lakh, as an operational risk mitigation measure, the signature of the Nominee/ Claimant shall be attested only by a Notary Public or a Judicial Magistrate First Class (JMFC) in lieu of banker’s attestation. For this purpose, space has been provided for signature in the TRF itself below the signature of the claimant.

l. While the list of documents mentioned above should be taken in all cases, in specific cases and situations related to transmission of units that are not enumerated in section 1 to 6 above, AMCs should adopt proper due diligence and request for appropriate documents depending on the circumstances of each case and apply the general principles enumerated in sections above before transmitting the units in favour of the claimant/s.